DOGE Price Prediction: Key Factors to Watch in August 2025

#DOGE

- Technical Outlook: Mixed signals with bullish bias as price holds above key moving average

- Market Sentiment: Divided between technical selling pressure and fundamental optimism

- Key Levels: $0.25 resistance and $0.19 support will determine next major move

DOGE Price Prediction

DOGE Technical Analysis: Bullish Signals Emerge Amid Consolidation

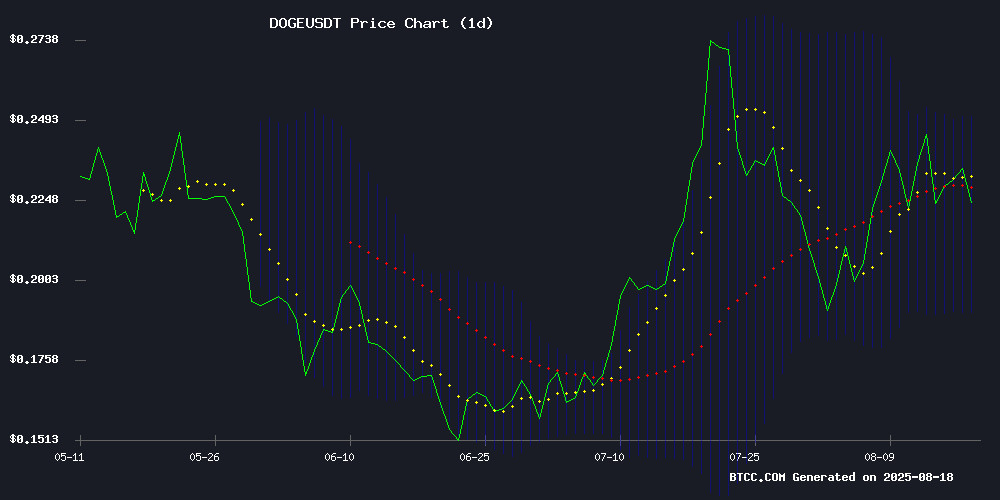

DOGE is currently trading at $0.2229, slightly above its 20-day moving average of $0.2203, suggesting near-term bullish momentum. The MACD histogram remains negative (-0.009745) but shows early signs of convergence as the signal line (0.000889) attempts to cross above. Bollinger Bands indicate a tightening range (Upper: $0.2503, Lower: $0.1904), which typically precedes volatility expansion.

"The price holding above the 20-MA while Bollinger Bands contract suggests accumulation," said BTCC analyst Sophia. "A decisive break above $0.250 could trigger algorithmic buying from traders watching the upper band."

Market Sentiment: Cautious Optimism for DOGE Despite Headwinds

Recent headlines reflect mixed sentiment for Dogecoin. While the failed Golden Cross pattern and selling pressure weigh on prices, sustained investor interest and ETF speculation provide support. "The market is digesting two competing narratives," noted Sophia. "Technical traders see bearish confirmation from the failed Golden Cross, while fundamental buyers focus on growing adoption potential."

Factors Influencing DOGE's Price

Dogecoin's Golden Cross Fails to Sustain Rally Amid Heavy Selling Pressure

Dogecoin's bullish golden cross pattern proved insufficient to counter mounting sell-side pressure as the meme cryptocurrency slumped below critical support levels. The token's 6% decline to $0.23 between August 17-18 came despite aggressive accumulation by whale wallets, now holding nearly 100 billion DOGE.

Market dynamics turned decisively bearish when Qubic's community voted to target Dogecoin for a potential 51% attack—a tactic recently deployed against Monero. This security concern compounded existing macroeconomic headwinds from escalating global trade tensions, creating perfect conditions for profit-taking.

Technical damage became apparent as DOGE failed to hold the $0.23 support zone after violent 7% intraday swings. The session's most telling moment came when a midday surge to $0.24 on 916 million volume was abruptly reversed, culminating in a 2% collapse within the final hour.

Dogecoin’s Technical Patterns and ETF Buzz Signal Potential Rally

Dogecoin (DOGE) shows signs of accumulation as it climbs 0.83% to $0.2329, with analysts identifying an expanding wedge pattern that could propel the memecoin toward $1.40. Grayscale’s updated SEC filing for a spot Dogecoin ETF adds institutional weight to the bullish case.

Trader Tardigrade’s weekly chart analysis reveals higher lows and highs, mirroring past surges of 120% and 190%. The current $0.21–$0.30 consolidation range since February underscores growing buyer interest, with rising lows reinforcing the uptrend.

Grayscale’s regulatory move aligns with Dogecoin’s technical narrative, blending meme culture with institutional credibility. Market watchers now weigh cyclical expansion against crypto’s volatility—a test of whether DOGE can transcend its joke-coin origins.

Dogecoin Maintains Investor Interest Despite Recent Price Decline

Dogecoin (DOGE) has seen a 4% depreciation this week, yet investor interest remains robust. Derivative markets recorded nearly 15 billion DOGE in trading volume over the past 24 hours, equivalent to $3.42 billion. The sustained demand is further evidenced by the total value of active futures contracts tied to the meme cryptocurrency.

Open positions in DOGE futures have increased despite the price drop, signaling market expectations of an upward trend. Gate.io leads with open positions totaling 3.29 billion DOGE ($750.2 million), representing 21.92% of the total market. Binance and other major exchanges continue to show significant activity, underscoring broad-based confidence in Dogecoin's prospects.

Is DOGE a good investment?

DOGE presents a high-risk, high-reward opportunity based on current technicals and market sentiment:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20-MA | +1.18% above | Short-term bullish |

| MACD | -0.009745 | Bearish momentum fading |

| Bollinger Band Width | 27.2% of price | Volatility expected |

Sophia cautions: "Retail investors should watch the $0.25 resistance level - a clean break could confirm upside, while rejection may retest $0.19 support."

Cryptocurrency investments are highly volatile. Past performance doesn't guarantee future results.